What are the US injection molding industry trends for 2022?

- Robust growth against the odds

- Resin shortage continues — includes steel and rubber

- Reshoring benefits OEM supply chain management

- A shift towards sustainability

- Anticipated growth in certain markets

- Increasing skill and labor gap despite growth

Plastic injection molding is a manufacturing technique that’s been used in our country for decades. However, new developments in the market are propelling this manufacturing technique forward, jumpstarting unprecedented changes in technology and demand. Thus, these new trends also bring in new advantages for the companies that utilize plastic injection molding.

Find out what the new U.S. injection molding industry trends for 2022 — and the coming years — are, and how you and your company could benefit from these developments.

Robust growth against the odds

Reports indicate that the plastic injection molding industry could continue exponential growth — despite the many setbacks experienced since the onset of the COVID-19 pandemic — over the next few years.

The global market size was valued at $265.1 billion in 2020 and is expected to develop at a compound annual growth rate (CAGR) of 4.6% for the next decade. While not an exponential boom, the prediction looks to be promising and sustainable for the rest of 2022.

This growth is backed by increasing demand for plastic parts from various industries. This includes commodity industries such as packaging, electronics, and home appliances, as well as medical and automotive markets.

Players in the U.S. plastic industry hope to maintain this growth by adopting Industry 4.0 despite resin and worker shortages. However, this entails significant implementation, which may slow down adoption as manufacturers attempt to create connectivity and data solutions.

Resin shortage continues — includes steel and rubber

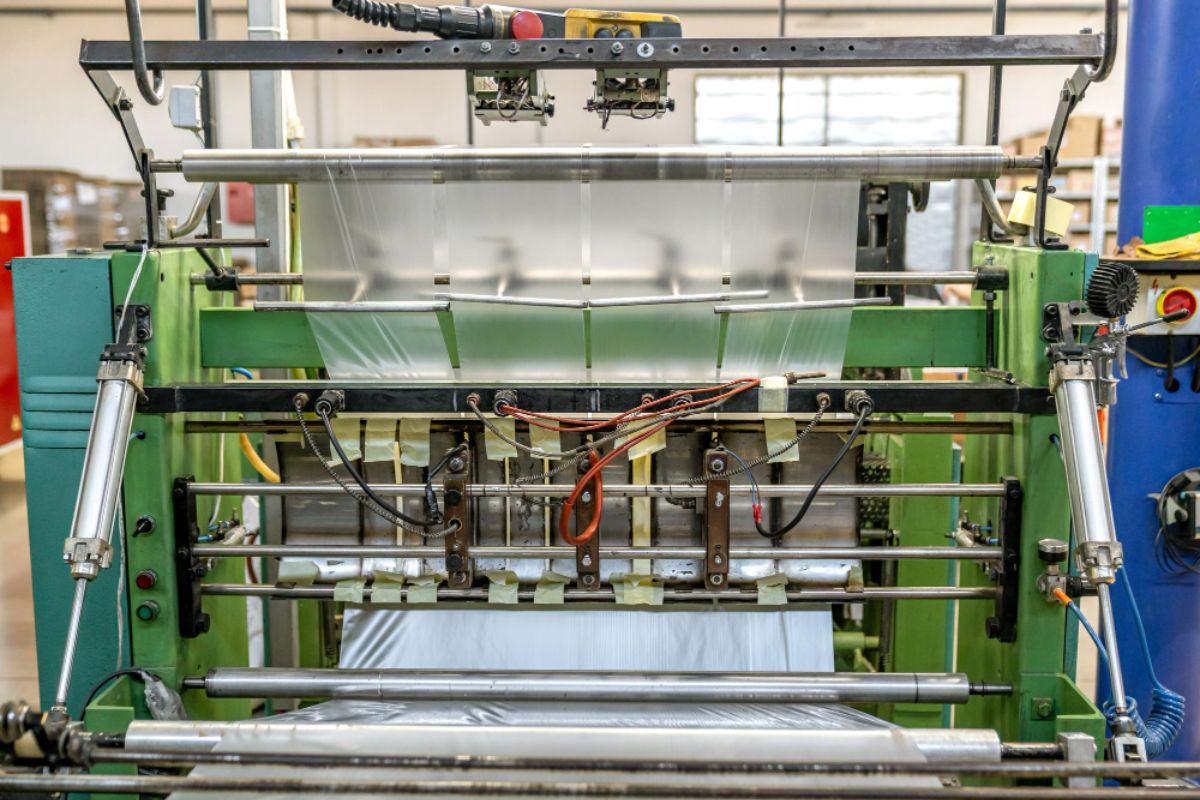

The resin shortages the U.S. industry faced in the previous year continue into 2022. The supply-demand-cost pendulum continues to swing for some commodity resins and is beginning to affect engineered resins.

The supply of resins containing additives such as glass fibers, flame retardants, and UV resistance is becoming increasingly strained. This puts pressure on supply chains, particularly for OEMs. In the case of glass fiber additives, manufacturers may continue adding surcharges to orders due to limited quantities. Accepting additional costs may be difficult for many manufacturers — which means that many engineered resins could remain in limbo this year.

In 2022, shortages begin to extend towards materials used in many value-added services in the injection molding industry, like insert molding. Insert molding primarily uses rubber and steel materials, which are scarce and in fierce demand in construction and automotive.

Adding onto supply strain are the transportation troubles and pricing volatility. Thus, steel and rubber are in high demand, causing prices to rise and creating new problems for custom injection molders and supply chain partners.

Reshoring benefits OEM supply chain management

Resin shortage is not the only logistical concern of the industry. After the massive supply chain troubles from the past two years, more companies are opting to bring their plastic manufacturing back home to the U.S., hoping to establish more reliable supply for critical parts and products. Reshoring production will shorten their supply chains, which in turn reduce shipping costs and lessen the risks of future disruptions.

Aside from transportation concerns, counterfeiting issues have begun to crop up in overseas supply chains — pushing more and more companies to reshore. Poor-quality raw materials and resins, stolen designs, substandard products, and other issues concerning the quality of products and services are increasing in recent years.

While diligence is encouraged for OEMs, they may still wind up with defective or inferior injection molded parts. Delivery timelines and transportation issues leave them with little time to find alternatives. These scenarios could play out more in 2022 if logistics issues persist.

While OEMs may hesitate at the higher initial investment with local manufacturers, these costs are offset by the unpredictability of the overseas market. Thus, we predict more companies will opt for reshored, streamlined OEM supply chain management as 2022 unfolds.

A shift towards sustainability

Despite all the problems in the U.S. supply chain, there is sustained demand in the industry. However, this coupled with the post-COVID recovery results in an increase in plastic waste. Additionally, volatile prices and difficult disposal of materials like ethylene, benzene, and styrene are pushing the industry to focus on the development of sustainability practices.

As the industry continues to adjust to new sustainability regulations, values, and practices, new injection molding trends point towards:

- Increased adoption of 100% recyclable plastic materials — emphasis on those that can be safely disposed of and are environmentally neutral.

- Research into manufacturing alternatives to reduce carbon footprint. This could lead to adopting renewable energy sources or developing technology with efficient energy usage.

- Development of injection-molded plastics using bio-based counterparts to overcome major material challenges.

Sustainability isn’t just a trend — in 2022, it becomes clear that these practices are crucial to the survival and future of the plastics industry. In 2022, we anticipate there will be more policies and regulations on the U.S. injection molding industry, and a push towards recycled or compostable plastics.

Anticipated growth in certain markets

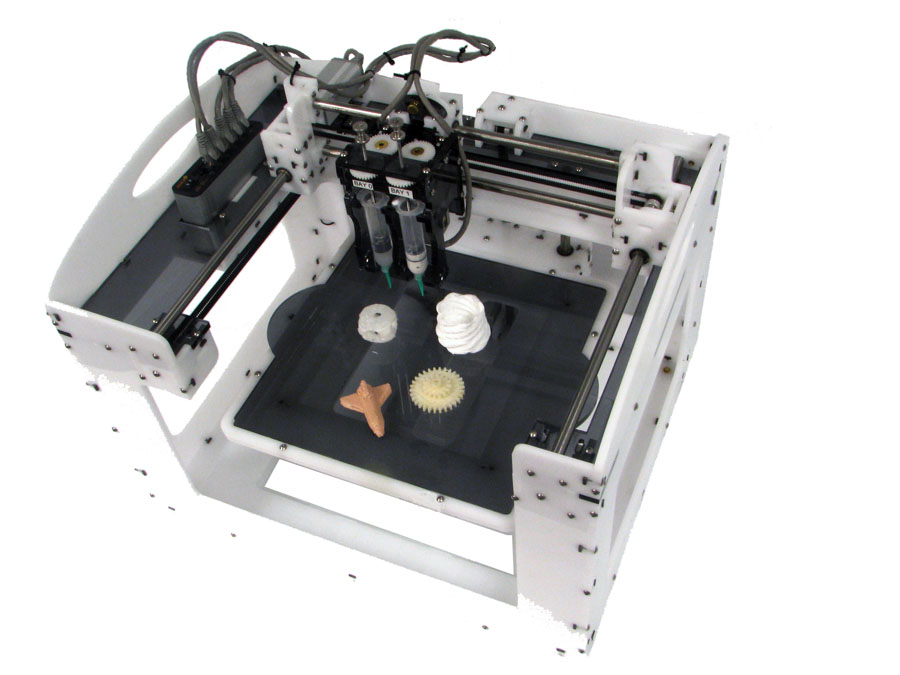

Certain market segments continue to dominate and experience positive growth in the U.S. injection molding industry. The packaging segment underwent various changes to cope with pandemic regulatory guidelines — such as increased shelf life for food products, increased durability, and improved sealing to prevent contamination. Weight solutions continue to be a concern for the packaging industry. Thus, a push for thickness reduction and the use of injection compression molding (ICM) methods are increasing.

ICM differs from conventional injection molding methods in that shrinkage is addressed without using additional materials in the holding phase. Instead, shrinkage is compensated for using a compression cycle, which entails displacement within the mold. The ICM technique makes savings of material of up to 20% possible.

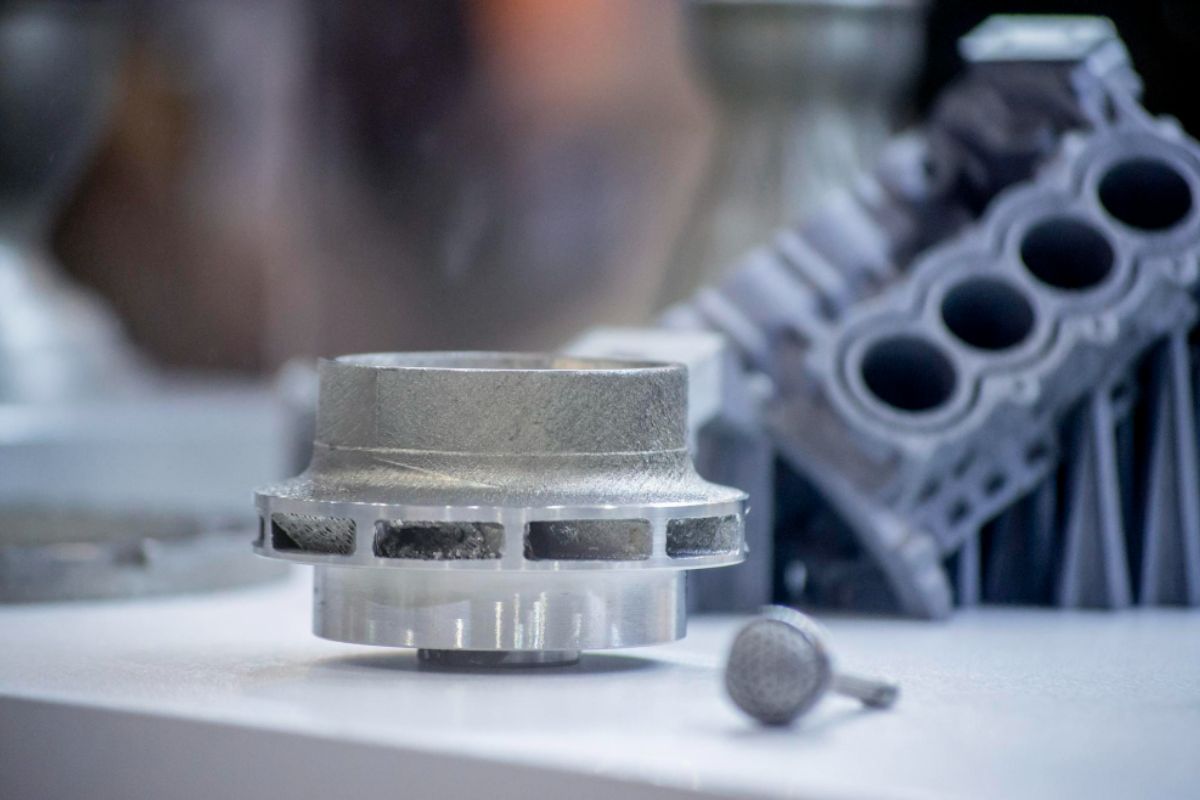

There continues to be immense potential in the medical and automotive industries. Medical devices and components in particular will have the highest growth in 2022. This is due to the gradual return of patients for non-critical and elective procedures.

Additionally, there is an increased investment in tech and innovation in the medical field — pushing injection molders to attempt innovations for medical devices and components. There is also a rising interest in adopting biodegradable resins for medical device manufacturing, which is predicted to create profitable opportunities for 2022.

For the automotive industry, there is a strong shift towards replacing metal components with plastics to make production more cost-efficient. This is expected to push demand for injection molding services in the U.S. over the next few years. Government regulations regarding iron and steel are also pushing automotive manufacturers to use plastics instead.

Increasing skill and labor gap despite growth

The U.S. plastics industry is a mature one facing hard constraints on exponential growth — particularly with their limited human capital. Statistics point towards a large portion of their workforce over the next decade will consist of workers aged 25-45. The question stands: will these workers be adequately trained to take over the large skill gap left by retired industry experts?

Recent studies are not optimistic — many believe that skill sets will be missing for the plastic injection industry. There is a need for industry learning programs to create a better-trained, more-skilled workforce. Otherwise, job openings in the next few years will be tough to fill.

Luckily, recent innovations and adoption in remote training and e-learning show promise. While these learning modes may never develop enough to replace onsite training, these can supplement traditional training methods.

E-learning takes 40-60% less time than in a traditional classroom — plus, trainees can learn at their own pace and go back to previous lessons and concepts when needed. While education may be difficult at this time, there is still hope to create a skilled workforce for the coming decade.

Key Takeaway

Based on the U.S. injection molding industry trends for 2022, we anticipate another healthy year for the industry. There is an expected moderate economic growth, despite issues concerning resin, overseas supply chains, and labor gaps. With reshoring and sustainability practices on the rise, supply chain issues may ease over the year.

If the past two years have taught the U.S. plastic injection industry anything, it’s to expect the unexpected. Robust partnerships, a skilled team, and flexibility will be vital keys to business success this 2022.