What are factors that impact resin pricing in China and the US?

- Upstream Assets and Feedstocks

- Inventory

- Industry Trends

- Labor and Production Capacity

- Capacity Adjustments

- Policies and Geo-political Events

Pricing for materials changes near constantly — in a single day, the cost of resin can go up and down multiple times. With so many volatile factors in the market, it is becoming increasingly difficult for plastic manufacturers and consumers to predict prices.

Price volatility greatly affects your business’ financial results. This can cause your profit margins to become narrower and narrower, resulting in a greater risk of loss. However, the factors that impact resin pricing can provide some predictability in your business’ raw material costs. This knowledge can help you better manage your operations and make smarter purchasing decisions.

Upstream Assets and Feedstocks

Upstream assets are what plastic refiners and manufacturers use in the production of crude oils and natural gases. These are market fundamentals that are affected by their country and their company’s drilling rights, physical extraction, and refining process.

At each phase of the plastic resin manufacturing process — from oils and gas to end products — there are regulatory, technological, and economic factors that affect the whole value chain. The more restrictions there are, the more expensive resins will be priced. Since the creation of this market, the US has been a strong competitor with multiple crude oil and gas collection and refining facilities all over the world.

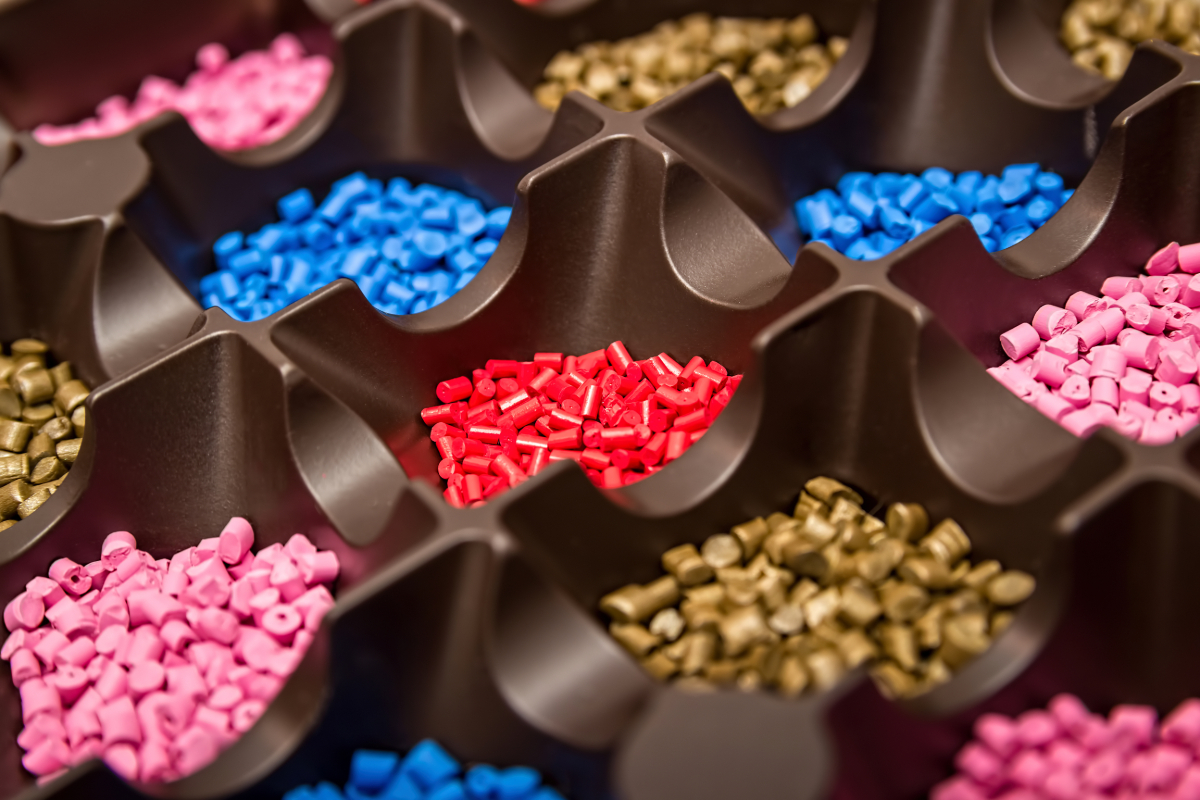

Feedstock on the other hand refers to the materials that are converted into plastic resins. These are the crude oils, natural gasses, as well as additives used in making different types of resins. The costs of these materials are affected by availability and market demand. When these materials are short in supply, producing the resins becomes more expensive. As a result, manufacturers may sell their resins at a higher price to recover costs from their customers.

Inventory

The inventory of plastic resins can also affect their market rate. If plastic manufacturers have a surplus of plastic — for example, polyethylene — they may offer their resins at a discounted price to reduce inventory costs.

Meanwhile, low supply often creates a high demand, which then increases resin prices. Most manufacturers will try to price their products competitively to meet supply and demand at any given time.

Generally, US manufacturers can keep their resin prices on the lower end due to their large crude oil and natural gas extracting and refining capabilities. The US has been at the top of the global market since the start of the trade, and as a result, has more control over resin pricing than most other countries.

On the other hand, China has been able to create a robust oil import and refining industry in the last decade. China’s goal is to add more capacity by establishing several new plants in India and the Middle East. By doing so, they are becoming a growing force in the international market for plastic resins — but they have yet to overtake the US in its top spot.

Industry Trends

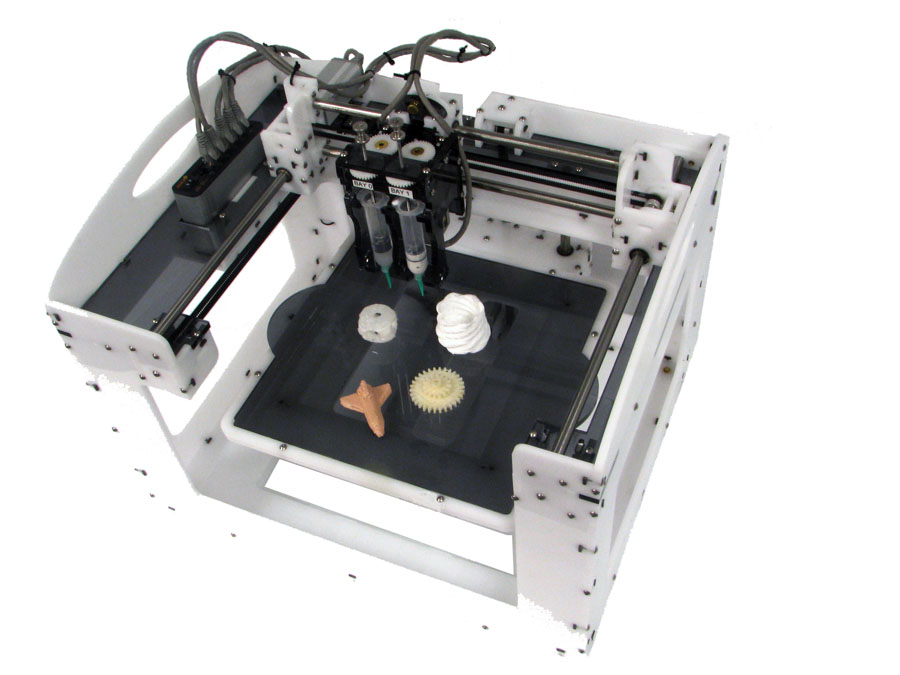

Trends among different industries have a hand at the prices of the industry as well. In the US, the demand for pre-packaged meals is growing, and as a result, the demand for plastic resins is increasing. This can lead to higher prices if the capacity for resin production is low, or if these facilities’ inventory is not able to meet demand. However, this growing demand can also further drive industry growth, which allows the country to establish more resin refining and production facilities.

There is also a growing trend of moving from rigid product packaging to flexible plastics. This is because the resins used in flexible packaging tend to be cheaper. This trend can lead to many facilities focusing on the acquisition and production of specific resins. With more facilities focusing on these materials, then these resins become cheaper for consumers to purchase as the producers create a surplus.

Labor and Production

The production of plastic resin also varies depending on the country it is refined in. US facilities often use feedstocks of natural gas. With polypropylene (PP), US manufacturers use crude oils. In other countries, like China, refining plants mostly use crude oils.

What this means is that the US-made plastic resin can be sold at a lower price when crude oil prices rise. On the other hand, when natural gas supplies are low, China-made plastic resins can be priced more competitively when compared to US products.

Another factor that affects resin pricing is the availability and cost of labor. In producing resins, your facility will need a talented workforce to create high-quality end-use products. When it comes to this factor, the cost of labor in US plastic resin manufacturers is generally higher than using those from China.

This is because labor is abundant and cheap in China. Labor wages are cheaper, there is a large, trained workforce available at any time, and there are fewer health and safety regulations to account for. However, using US-based labor has the benefits of added policies and regulations to ensure high-quality products that can meet demanding standards — such as the products used for medical or automotive industries.

Capacity Adjustments

The industry’s capacity to meet demand can also impact the prices of plastic resin. This includes the production, transportation, manufacturing processes. For example, if there is high demand for polyethylene resins, but many refining facilities have delayed material deliveries due to inclement weather, then their end-product pricing will be raised.

The US market has a great capacity for plastic resin production, however, this capacity is greatly affected by outside forces — such as the ongoing COVID-19 pandemic. Many US-based facilities have shut down over the last year due to financial and logistic problems caused by the virus. Another factor affecting US capacity is the push for biofuels, which has caused some businesses to repurpose their facilities and stop producing resins.

Having too many facilities can also negatively affect pricing. This happens when production outpaces demand, causing a surplus. This is the case with the China market. New refining and manufacturing plants have increased their production capacities beyond the predicted demand growth. If the market demand stays on the predicted trend for the next few years, then these China-based facilities may shut down.

Policies and Geo-Political Events

Policies and events that affect the demand for plastic end products can increase or reduce demands for resins. These changes can be felt on local and international scales. For example, if the US makes a push for plastic alternatives — such as biodegradable packaging — this will reduce the demand for single-use packaging made from polyethylene resins.

On the other hand, events that push countries to produce more single-use plastics for sanitary reasons will greatly increase the demand for plastic resin. One current geopolitical event that is doing so is the pandemic. From the medical industry down to the regular consumer, there is still the ongoing demand for PPE like face masks, face shields, and disposable gloves.

Certain policies and events make plastic resin prices soar due to high demand, and these prices will be especially high if there is low inventory and capacity of the plastic resin industry. In contrast, governments and trends moving towards alternative products can also cause demand to drop, forcing manufacturers to price their resins competitively to reduce loss.

Key Takeaway

Given the many factors that impact resin pricing, it can be difficult for many to accurately predict the pricing trends. However, being aware of the possible changes can help you get a better handle on the market and its associated risks, giving you a clearer image of your overall management plans.

If your business is a customer of plastic resins, investing in a reliable partnership with experienced manufacturers can help you in keeping abreast of fluctuating prices and unexpected costs. With a partner like Richfields, you can trust them to supply high-quality resins at the best prices you can afford despite the unpredictable market.